This text aims to explain the Rent to Own / Rent to Buy process, the reasons for renting to buy, benefits and possible problems. We provide an example to illustrate the concept but please bear in mind that it’s just one of many possible ways to structure the contract. Rent to Own deals tend to be very flexible to suit the situation of the actual buyer.

Please note: The following explanations are simplified and may not necessarily reflect all the specifics of your particular case. Always consult your lawyer before making the final decision to buy or sell a property.

Rent to Own vs Rent to Buy

You may have heard both terms. What’s the difference? Nothing at all. Rent to Own and Rent to Buy are just two names for the same process. We will use them interchangeably in this text.

Why Rent to Own?

Some buyers can’t purchase a house directly on the market due to a number of reasons. For example they may not have yet saved enough deposit, they may have some unresolved credit issues, perhaps they are waiting for a residency or for some other reason don’t yet qualify for a mortgage. Our Rent to Buy scheme is designed to allow people like this to:

- immediately move into their new home, and

- buy it later for a prenegotiated price

The process may take up to a number of years however the specific terms vary from property to property.

When we secure a property suitable for Rent to Own we announce it by email to all our registered clients with details of an Open Home date and time. If you want to know about our upcoming Rent to Own Open Homes please register here.

Rent to Own process

- Terms are negotiated. Typically the contract is for 3 to 5 years but very often is negotiable both ways.Example: Minimum term is 1 year, maximum term is 5 years. That means the buyer can purchase the house at anytime after the first year and before the end of the 5th year.

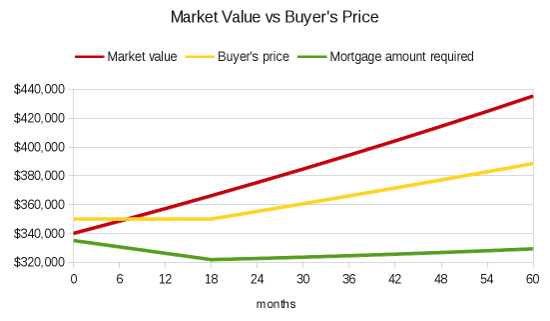

- The current valuation is obtained. It is safe to assume that house prices in Auckland will rise on average by 5% per year over the foreseeable future. Most likely even more than that.Example: Current registered valuation is $340,000. In two years the market value is expected to be around $370,000, at the end of the 5 years term it should be around $430,000.

- The future purchase price is negotiated at or near the current valuation of the house. Sometimes it may be fixed for a couple of years, in other cases it may increase by a predefined amount every couple of months. Typically the price increase is negotiated below the expected market increase.Example: Purchase Price $350,000 is fixed for the first 2 years, then increasing by 1.5% every 6 months. At the end of 5th year the purchase price will be exactly $382,705. regardless of the market value.Compare that with the above mentioned market price of $430,000 – you can immediately have nearly $50,000 equity at the moment of purchase.

- You – the Buyer – pay a small upfront payment and move into the house as a tenant. Usually between 3% and 5% of the agreed purchase price is required upfront.Example: Minimum of $15,000 may be required in our example deal. However offering a higher than minimal deposit gives you a better chance to secure the contract for you.

- For the duration of the contract the Buyer pays a weekly rent and becomes a Tenant-Buyer. A portion of the rent is credited towards the final purchase price.Example: Rent is agreed to be $480 per week, that includes $50 per week reduction of the purchase price (weekly credit). Many people prefer a higher rent with an even higher credit, for example $520 weekly rent may include $100 weekly credit, $580 rent may include $170 weekly credit. Over the years the credits will accumulate to a significant discount off the purchase price. For example in 5 years the $50 weekly credit makes $13,000 discount, the $100 option makes $26,000 and the $170 per week option makes a whopping $39,000 discount off the purchase price.

- Once the buyer qualifies for a mortgage they buy the house. A current registered market valuation will be obtained, the initial down payment and the accumulated weekly credits will be recognised by the bank as a deposit.Example: In 5 years the registered valuation will come out at $430k. The purchase price will be $382,702, less $15,000 down payment, less $39,000 weekly credits which means the buyer will only need $328,702 loan to purchase the house. That’s only 76% of the registered valuation – any bank in New Zealand will be happy to finance such a deal.

Compare that with a direct purchase instead of renting to buy – with a deposit of $15,000 and a purchase price same as the initial market value of $340,000 you would be applying for a 96% mortgage. Good luck!

The red line indicates the market price that you would have to pay for the same property in the future without renting to own. The yellow line is your future purchase price, however with the upfront payment and weekly credits applied the amount of the mortgage loan required is a lot lower – see the green line. With rent to own you’re going to be a lot better off than a random cash buyer at any point in the future would be.

Benefits of Rent to Own

- Very little money is required to secure your dream home.

- Purchase price is pre-negotiated below future market price.

- You live in your own home before you buy it.

- No obligation to buy the house if for some reasons your circumstances change.

What about renovations?

The key to easily qualify for a mortgage is to reduce the amount required from the bank below 80% of the registered valuation (aka 80% LVR = Loan to Value Ratio). That can be done by waiting long enough while accumulating the weekly credits as shown above. Alternatively to speed up the process the buyer can renovate the house – that will increase it’s value and quickly reduce the LVR.

Example: At the end of 2nd year our example house has a market value of $366,000, at the same time the purchase price is still fixed at $350,000. Less credits and upfront payment the loan amount needed is $321,000. That means $321k/$366k = 88% mortgage – not impossible to obtain but not quite a sure thing either.

To increase your chances you can repaint the house, put in a new kitchen, modernise the bathroom, do some landscaping, fully fence it and repair the deck. Since you are a handy DIY kiwi you only spend money on the materials and invest your own time and energy to the project. Once everything is done the new valuation comes out at $425,000 – that’s a great reward for all the effort. Your mortgage loan amount is now well below 80% and you get the mortgage approved without any problems.

Renovating a house is a great way to improve your chances for a mortgage and reduce the duration of your Rent to Own contract.

Frequently asked questions

- Am I obliged to purchase the house?

- No. We strongly recommend you do buy it because the initial down payment and weekly credits are not refundable. However if your circumstances change you can just walk away. No problem.

- Can you sell the house to someone else while we live in?

- No we can’t. While the contract is current we can by law only sell the house to you and not to anyone else.

- Can I transfer the contract to someone else?

- Yes you can. The contract is fully transferable and you can sell it or give it to anyone who may be able to buy the house if you can’t do it yourself.

- Why is the rent higher than a market rent?

- Because it accounts for the weekly credits that ultimately reduce your final purchase price. You also pay a small premium for the certainty of a fixed or predictable future purchase price and for preventing us from selling the house to anyone else.

- Is this actually legal?

- Absolutely! You will be required to get an independent legal advice and your lawyer will talk you through the contract before you sign it.

- Can you let me know when you have the next Rent to Own house available?

- Sure! Just register as a Buyer and we will be in touch!